Friday’s stock market had a distinct sense of deja vu about it. Even though it was down overal, I was reminded of the crazy dotcom days in late 1999 when any tech stock could rally 25-50% in a single day!

One of my friend’s subscribes to a stock newsletter. Periodically he gets an email alert informing him when a stock is about to make a significant jump. He often sends them to me and I usually look at them and then ignore them. Yesterday he sent me an email about a China Clean Energy Inc (CCGY.OB).

By the time I got the email, it had already jumped 30% that day, but I really liked the chart. It had retreated about 15% from the highs of the day and looked like it was ready to make a move back up to the $2 range.

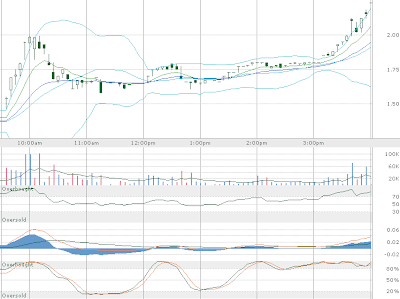

This is what the chart that I follow looks like.

The image is bit hard to understand since they’re aren’t any notations on it. The first chart is the intra-day stock price of CCGY.OB for September 28th 2007 using Candlesticks. It also has the bollinger bands and exponential moving average lines.

The 2nd chart with red and blue vertical lines denotes the volumne. The 3rd chart is the Relative Strength Index (or RSI) with oversold and overbought indicators.

The 4th chart is the Moving Average Convergence/Divergence indicator orMACD.

The last chart is the Slow Stochastic.

From these charts I felt that there was sufficient momentum in the stock to carry it higher, despite it having already jumped 30%. I was able to buy in at $1.73 around 12 pm EST (which was 9 am for me) and sure enough it continued higher throughout the day.

It closed the day at the highest price of $2.23, for a stunning 28.9% one day gain! Although the stock was up ~60% for the entire day, I was very happy with my 28%. Made me feel like I was reliving the good old dotcom (or dotbomb) days.

Here’s a much better daily chart.

Very rarely do I buy stocks based on tips and without looking at any underlying fundamentals. Usually, the newsletters that I subscribe to, will recommend a stock based on good, solid fundamentals and I will use the charts to determine the market sentiment for that stock and a good entry point. Recently, Freight Car America (RAIL) was recommended, but the chart looked terrible and I didn’t buy it. Sure enough it dropped from it’s recommended price of $48 and is now trading at $38. Here what the chart looks like. I’ll wait until the technicals improve before I jump in on that one.

Sometimes this strategy will backfire because some breaking news will come out that will send the stock shooting the opposite direction than expected, but it doesn’t happen often enough. And unexpected news can make value investors look like fools too!

Most traders use some form of technical analysis. Many investors believe that technical analysis is rubbish and doesn’t work, but they probably feel that way because they don’t understand it. Its basically a representation of the current market sentiment based on price and volume action.

Most traders use some from of it and it can get fairly complex. Studies have shown that currency traders use it a lot (or atleast the successful ones!). I’ve attended several currency traders meetup sessions and they all use some sort of technical analysis to trade in and out of their positions. That and proper money management is the key to succesful trading.

I strongly recommend at least learning the basics and deciding for yourself whether to use it or not. Getting Started In Technical Analysis is a really good book that’s fairly easy to read.

If you’re interested in learning about trading, I strongly, strongly recommend Trading for a Living: Psychology, Trading Tactics, Money Management. By far one of the best introductory books on the subjects. You’ll get more out of it than a $5,000 seminar!

If you like to day (or swing) trade, you’ll also enjoy An American Hedge Fund: How I Made $2 Million as a Stock Operator & Created a Hedge Fund. A fascinating story about Timothy Sykes, a college student who made a million dollars day trading and started his own hedge fund.

![p[Get 77% returns with this stock newsletter]](http://i243.photobucket.com/albums/ff92/reallykool/AD_newsletter.jpg)