As I’ve mentioned before I think the US is going to enter a period of inflation and recession brought on by the trade & budget deficit and precipitated by the devaluing dollar.

Both Oil and Gold have been in a slow and quiet bull market for the past few years. Historically both of them have been rising & falling in tandem and I believe that both of them have quite a bit further to go. I know that people [Iran’s oil minister, a few economists and the all-knowing Steve Forbes] have been bearish on the price of oil for the past year now but it keeps going up. I think both oil and gold have a lot of room for further appreciation especially if the US Dollar devalues. It may be showing current strength, but I think thats just a short-term spike.

Compared to historic prices, both commodities are still quite low. On top of that, there’s a renewed demand from both India and China. In the last quarter, India consumed 30% of the global gold supply, up 47% from a year before. Plus the booming economies of the world’s most populous countries will just “fuel” the demand for oil.

So how to play these two markets? One way is to buy an oil well, the feasibility of which I’m currently looking into. I’d recommend buying a gold mine, but thats probably not going to happen. Gold mining companies are thinly capitalized and never seem to make any decent amount of money. But their shares seem to be doing well. So either buy gold shares or buy gold bullion. Stay away from rare numismatic gold coins unless you really know what you’re doing.

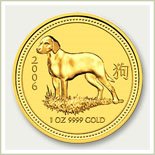

In many parts of the world holding gold is considered auspicious and brings good luck, so I think I’ll buy some gold coins. I’ve settled on the Perth Mint Lunar gold coin series. The mint brings out a new Chinese Lunar coin every year. Its considered bullion grade and the Snake 1 ounce gold coins sell for near their intrinsic value, which is currently around $547. [the current spot price of gold is around $508 and there’s always a bit of slippage involved.] As a comparison, the bullion grade American Eagle sells for the same price. The horse, goat and other coins in the series sell for about $557. These coins are a good alternative to the Canadian Maple leaf coins that have the same amount of gold at the same quality but are not protected in individual plastic cases.

![[Perth Mint Lunar Series Gold Dragon 1 Ounce coin]](http://www.livingoffdividends.com/wp-content/uploads/2008/03/perth_mint_lunar_series_gold_dragon.jpg)

There is a limited production of 30,000 1 ounce gold coins of each animal in the Lunar series. Since the Dragon coin in the lunar series has become a collectors item and is now begin sold for nearly $900, there is a possibility that the other coins will also rise in value over their intrisic value.

You usually have to wire funds into the dealers account, which costs $30 and there’s a $15-25 dollar shipping charge per order, so there’s some considerable cost over the spot price gold per ounce. [ $508 versus $547+ $30 + $20 ]. Although if you buy at least 5 coins the dealers normally give you a slight discount per coin ($5-10) and over 10 coins, the shipping is free too.

But be careful with whom you deal with. I spoke to 3 dealers. One of them was very nice. Another was very expensive, $609 for the Snake coin, and a third told me they were completely useless and I should buy some weird gold coin that was a third of an ounce. Stay away from all coins that are not 1, 1/2, 1/4, 1/10 or 1/20 ounce. Selling them is always a hassle.

Incidentally I bought a 1/4 ounce Dragon coin on ebay over the weekend. Its probably not going to appreciate like the 1 ounce Dragon because there are twice as many minted, but its a cool looking coin and it only cost $142.50.

I called to ask my Mom what she thought about the whole and she thought it was a great idea. She strongly encouraged me to buy as many 1 ounce coins as I could. Funny how everyone suddenly thinks you’re loaded just because the bank was stupid enough to lend you a million dollars!!!

Gold has retreated quite a bit since its high of $730 on May 11th 2006. Its currently trading around $630/oz. I see this as a good buying opportunity. While I’m against dollar cost averaging, I think gold is in the beginning of a bull cycle and this justifies buying on dips.

Gold has retreated quite a bit since its high of $730 on May 11th 2006. Its currently trading around $630/oz. I see this as a good buying opportunity. While I’m against dollar cost averaging, I think gold is in the beginning of a bull cycle and this justifies buying on dips.

![[1 Ounce Perth Mint Lunar Series Silver Dragon]](https://photos1.blogger.com/blogger/4467/604/200/aust.2000.dragon.jpg)

![[Perth Mint Lunar Series Gold Dragon 1 Ounce coin]](http://www.livingoffdividends.com/wp-content/uploads/2008/03/perth_mint_lunar_series_gold_dragon.jpg)