Tesla just pre-sold a whopping 325,000 Tesla Model 3s.

Yup, excited buyers gave the company $325 million in an interest-free loan for a car they haven’t seen, or who’s factory still hasn’t been built yet.

The excitement is understandable.

And it’s remarkable that a car company with no advertising, and no dealers can get people to stand in line for hours to buy a car that won’t be ready for over a year. Most of the people in line will have to wait 2 years, and probably won’t receive the $7,500 tax credit for electric cars either.

The key component to the car is the battery. Tesla is still building the gigawatt battery plant in Nevada, and is expected to be a large consumer of global Lithium ion production.

By the time Elon Musk’s prediction of rolling out 500,000 cars rolls around, it will most likely absorb the entire world’s annual Lithium production!

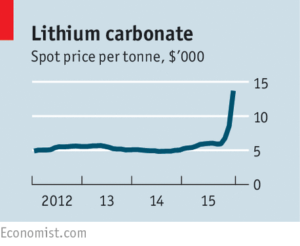

Unsurprisingly, prices for Lithium has soared, doubling this year.

This chart from the Economist shows prices up 3 fold from the long-term average of $5,000 per tonne. There are also rumors out of China that prices might double again from here.

If Tesla is absorbing the entire global production what are the other electric car manufacturers going to do, not to mention the makers of power tools, household appliances and rechargeable batteries, that all use Lithium ion as well.

Sounds likes it’s time for a short-term speculation in Lithium exploration/production companies!

While gambling on these sort of things rarely work out, if you’re so inclined, you might want to check out Global X’s Lithium ETF, which invests in the full lithium cycle, from mining and refining the metal, through battery production.

The fund isn’t exactly cheap, with a 0.77% expense ratio, and it owns 25 different companies, with Tesla (TSLA) being one of them. Also, two companies consist of 28% of the fund – FMC Corp and Sociedad Quimica Y Minera De Chile (or The Chemical and Mining Company of Chile, cutely called SQM).

According to Morningstar analysis, FMC is undervalued by about 20%, and SQM is overvalued by 25%. While valuations are highly subjective, Morningstar is a good quality resource at a cheap price.

I’ll probably pass on this fund, despite the fact that it’s an interesting opportunity.